In today’s digital economy, data is a strategic asset. For financial institutions, effectively monetizing data is key to unlocking new revenue streams, improving operational processes, and delivering personalized customer experiences. However, achieving this requires a clear strategy, advanced analytics, and compliance with regulatory frameworks.

- Revenue Growth: Turn insights into profitable products for partners and clients.

- Customer Engagement: Data-driven personalization drives loyalty and retention.

- Competitive Advantage: Institutions that prioritize data monetization stay ahead of disruptors.

In a fast-changing landscape and competition intensifies, monetizing data is no longer optional—it is a necessity.

From Insight to Impact

The financial sector is evolving rapidly, driven by digitalization and fierce competition. At the center of this transformation is data monetization, a powerful tool to generate growth and redefine customer experiences.

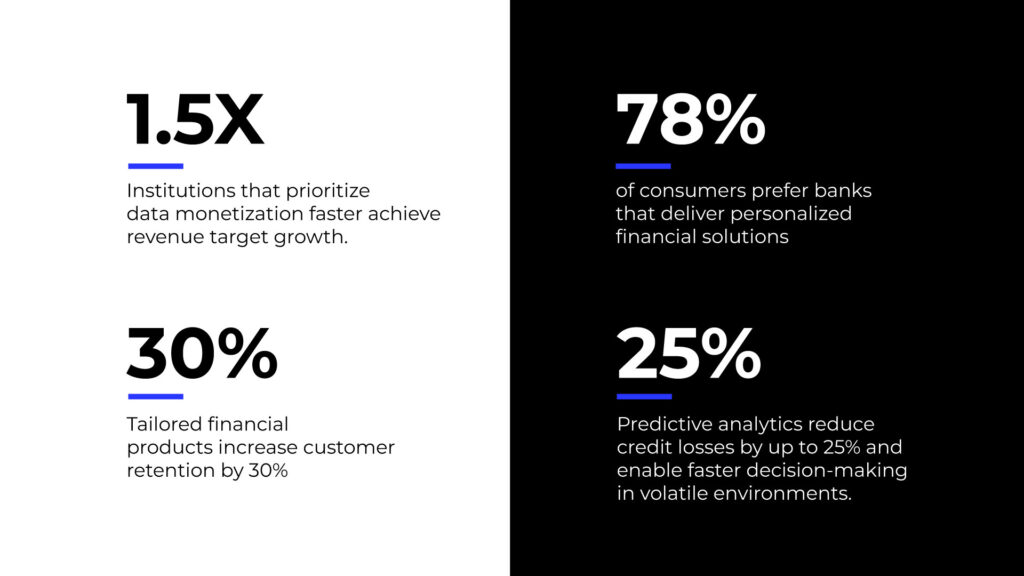

While financial institutions generate vast amounts of data daily, the value lies in turning raw data into actionable intelligence. According to the World Bank’s 2024 Global Economic Report, institutions that prioritize data monetization achieve 1.5x faster revenue growth and greater efficiency than their peers.

The Strategic Case for Data Monetization

- Unlocking New Value Amidst Shrinking Margins

With shrinking net interest margins—declining by an average of 12% over the past five years (IMF Financial Stability Report, 2023)—financial institutions are under pressure to identify alternative revenue streams. Data monetization presents a lucrative opportunity.

For example, a leading Asian bank generated $15 million annually by offering anonymized consumer spending insights to retail and government partners (Statista, 2023).

- The Shift to Hyper-Personalized Services

According to Statista (2023), 78% of consumers prefer banks that deliver personalized financial solutions. Leveraging behavioral data and AI enables banks to tailor products and services to individual preferences, driving customer satisfaction and retention.

- Staying Ahead of Fintechs

Global fintech investment reached $180 billion in 2023 (OECD, 2023), intensifying competition in the financial sector. Traditional banks must leverage their rich data ecosystems to remain relevant, outpace disruptors, and innovate faster.

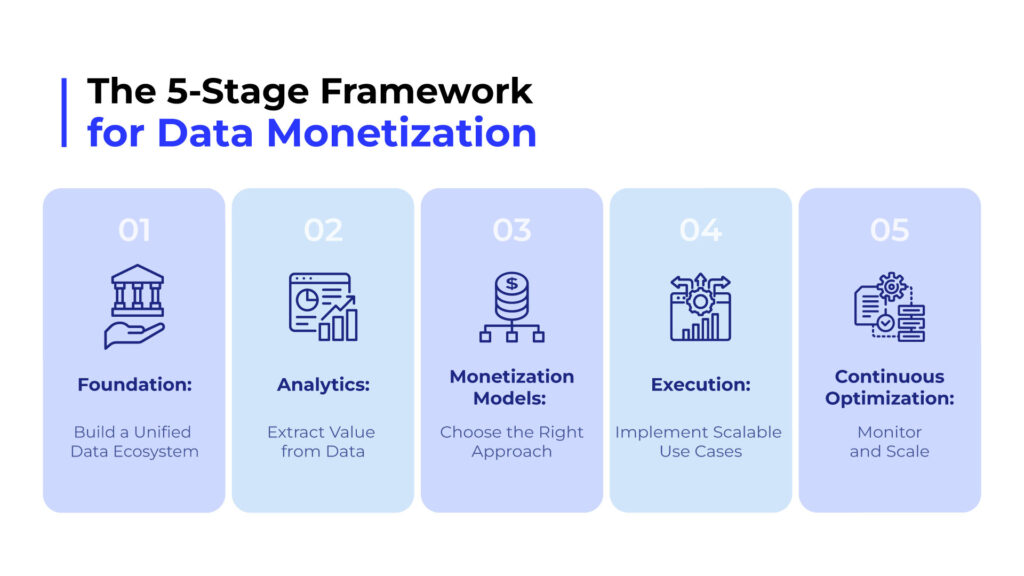

The 5-Stage Framework for Data Monetization

Bluebik emphasizes that achieving success in data monetization requires a structured framework that turns raw data into actionable insights and measurable business impact.

1. Foundation: Build a Unified Data Ecosystem

The foundation for data monetization is a centralized and secure data infrastructure.

- Key Actions:

- Break down silos to integrate data into a single source of truth.

- Ensure data accuracy, quality, and integrity through governance frameworks.

- Comply with Thailand’s Personal Data Protection Act (PDPA) to protect customer privacy.

2. Analytics: Extract Value from Data

Advanced analytics transforms raw data into actionable insights that drive revenue and efficiency.

- Key Actions:

- Use predictive analytics to anticipate customer needs and risks.

- Enable real-time data processing for fraud detection and customer engagement.

- Using Agentic AI to develop automated financial advisory models based on marketing data and customer behavior to create hyper-personalized services.

3. Monetization Models: Choose the Right Approach

Banks must identify monetization strategies aligned with their objectives.

- Direct Monetization:

- Sell anonymized insights to ecosystem partners like insurers, retailers, or government agencies.

- Example: A European bank generated over $12 million annually by providing subscription-based data analytics (Statista, 2024).

- Indirect Monetization:

- Use data to enhance internal processes, improve customer retention, and reduce costs.

4. Execution: Implement Scalable Use Cases

Deploy practical, high-impact data monetization use cases with measurable ROI.

- Use Case Examples:

- Fraud Detection: AI-powered tools reduce fraud-related losses by up to 40% (Forrester, 2023).

- Personalized Products: Tailor savings plans or loans to individual customer profiles.

- Operational Efficiency: Automate regulatory compliance and streamline approvals.

5. Continuous Optimization: Monitor and Scale

Ongoing performance measurement and scalability are critical for long-term success.

- Key Actions:

- Monitor KPIs such as revenue growth, cost savings, and customer retention.

- Adapt to regulatory changes and market shifts.

- Scale proven use cases across departments or regions.

The Impact of Data Monetization on Financial Services

1. Fraud Prevention and Detection

Fraudulent activities remain one of the biggest risks for financial institutions. Advanced AI and machine learning systems analyze large datasets in real-time to identify unusual patterns and flag potentially fraudulent transactions.

- How it works: AI models compare transactional data against historical trends to detect deviations, such as rapid purchases across multiple locations or inconsistencies in account activity.

- Impact: According to Forrester Research (2023), AI-enabled systems have reduced fraud losses by up to 40%, minimizing false positives while improving operational efficiency.

- Example: A European bank implemented AI-driven fraud monitoring tools, reducing fraud incidents by 35% within the first year and lowering operational costs by 25% through automation of manual fraud review processes.

2. Hyper-Personalized Financial Products

Personalization is no longer a “nice-to-have” but a critical differentiator in banking. Hyper-personalization leverages behavioral data, spending habits, and life-stage indicators to create tailored financial products.

- How it works: Banks use AI-powered customer segmentation to analyze individual spending behaviors, credit histories, and savings patterns to recommend or customize products like loans, investment portfolios, or credit cards.

- Impact: Statista (2024) reports that tailored financial products increase customer retention by 30%, as customers feel more aligned with their financial institution’s offerings.

- Example: A Southeast Asian bank launched personalized credit card offers based on spending patterns, resulting in a 20% boost in cross-selling rates and a 15% increase in active card usage within six months.

3. Embedded Finance in E-Commerce

Embedded finance integrates banking services seamlessly into non-financial platforms like e-commerce marketplaces, ride-hailing apps, or travel booking websites. This approach eliminates friction in the customer journey and extends financial services beyond traditional banking channels.

- How it works: APIs and AI enable banks to offer services like instant credit approvals, buy-now-pay-later (BNPL) options, and embedded payments during the e-commerce checkout process.

- Impact: Embedded finance is projected to drive $230 billion in new revenue opportunities globally by 2028, according to Juniper Research (2023).

- Example: A Thai fintech integrated embedded finance into a popular e-commerce app, allowing instant loan approvals for large purchases. This led to a 25% increase in transaction sizes on the platform and expanded the bank’s reach to younger, tech-savvy customers.

4. Predictive Risk Analytics

Predictive analytics helps financial institutions proactively manage risks such as credit defaults, market volatility, or regulatory breaches. By analyzing historical and real-time data, predictive models generate early warnings for potential risks.

- How it works: AI models evaluate credit histories, market trends, and external factors (e.g., economic forecasts) to predict default probabilities or market downturns.

- Impact: According to the World Bank (2024 Financial Stability Review), predictive analytics reduces credit losses by up to 25% and enables faster decision-making in volatile environments.

- Example: A leading bank in Thailand used predictive models to identify customers at risk of defaulting on loans. By offering preemptive restructuring options, they reduced loan defaults by 15% and improved repayment rates by 20%.

5. Strategic Partnerships with Ecosystem Players

Data monetization extends beyond internal operations. By anonymizing and aggregating insights, banks can create valuable data products for ecosystem partners such as insurers, retailers, and even government agencies.

- How it works: Insights derived from consumer spending patterns, credit trends, or regional economic activity are packaged as products for subscription-based analytics platforms.

- Impact: These partnerships not only generate new revenue streams but also strengthen relationships with key stakeholders. For example, insurers can use bank insights to fine-tune their premium pricing models.

- Example: In 2023, JPMorgan Chase partnered with Airbnb to analyze anonymized transaction data, helping Airbnb refine its pricing algorithms and identify new market opportunities. By leveraging spending patterns and regional economic trends, Airbnb improved its dynamic pricing model, leading to a 5% increase in booking revenue. Meanwhile, JPMorgan expanded its data-driven services, strengthening its role as a financial insights provider. (JPMorgan Chase Data & Analytics Initiatives (2023) (Check JPMorgan Chase’s newsroom for related reports.))

Bluebik’s Expertise: Unlocking the Full Value of Data

At Bluebik, we specialize in enabling financial institutions to unlock the full potential of their data with a strategic approach:

✅ Strategic Planning & PMO: Align data initiatives with business goals through structured planning, governance, and execution excellence.

✅ Unified Data Ecosystems: Break down silos and centralize data for actionable insights.

✅ AI-Powered Analytics: From fraud detection to customer personalization, we implement advanced analytics to drive growth.

✅ Compliance-First Strategies: Ensure adherence to regulatory frameworks, including PDPA and other local requirements.

✅ End-to-End Monetization Solutions: Develop scalable models for direct and indirect monetization tailored to your business objectives.

Data monetization is no longer optional—it is a strategic imperative.

📩 Contact us today to explore tailored strategies that drive measurable results for your organization.

☎ 02-636-7011

![Thumbnail [Post Event] HOW](https://bluebik.com/wp-content/uploads/2025/12/Thumbnail-Post-Event-HOW.png)