In today’s business landscape, the insurance industry stands at a critical inflection point. Amid rapid technological disruption, escalating customer expectations, and intensifying market competition, traditional insurance businesses can no longer afford to maintain the status quo.

While Digital Transformation can dramatically enhance organizational efficiency—significantly reducing operational costs and exponentially increasing revenue—the journey toward meaningful change is far from simple. Numerous challenges must be confronted and overcome along the way.

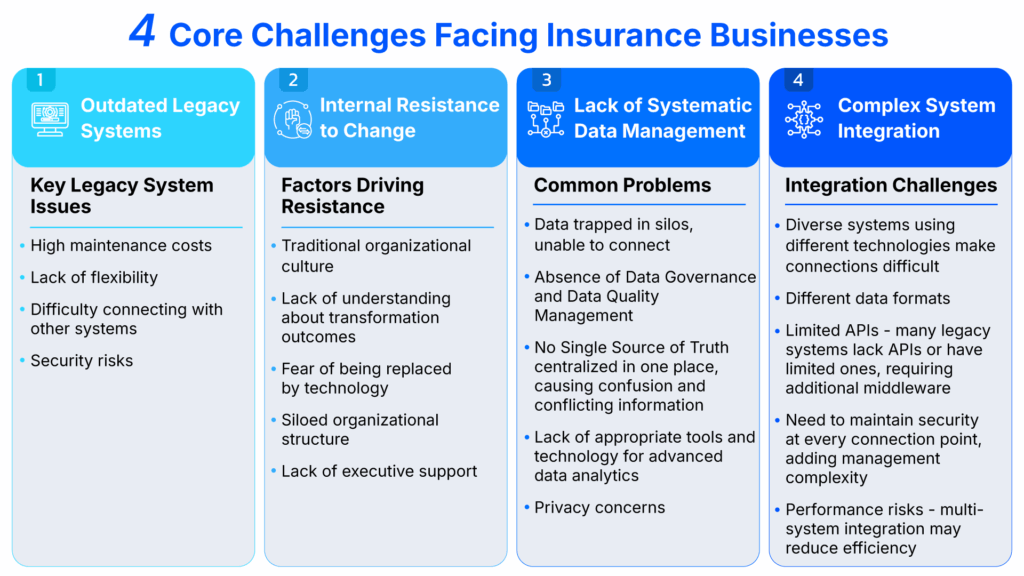

Four Core Challenges Facing Insurance Businesses

1. Outdated Legacy Systems

Legacy systems represent one of the most significant technological hurdles for insurance companies embarking on business transformation. In today’s data-driven world, where new technologies grow increasingly complex, these aging systems lack the agility and scalability necessary to support new features and capabilities.

These systems are like massive icebergs hidden beneath the surface—still functional, yet serving as critical barriers to development and competition. Imagine competitors launching new products within weeks while your company requires months, simply because your systems cannot accommodate rapid change.

Key Legacy System Issues:

- High maintenance costs: Maintaining outdated systems costs more than investing in new ones—resources that could fund innovation

- Lack of flexibility: Extended timelines for developing new features or improving business processes, resulting in lost opportunities

- Integration difficulties: Inability to efficiently connect with modern systems or APIs, preventing leverage of emerging technologies

- Security risks: Unpatched legacy systems create vulnerabilities, exposing organizations to cyber threats

2. Internal Resistance to Change

Another major challenge preventing successful organizational transformation stems from resistance to changing work processes or adopting new technologies. Internal resistance often proves the most challenging obstacle—not because of technology, but due to organizational mindset and culture.

Factors Driving Resistance:

- Traditional organizational culture: Comfort with existing methods and fear of change; long-tenured employees attached to current processes

- Lack of understanding about transformation outcomes: Employees cannot visualize how changes will improve their work; ineffective communication strategies

- Fear of technology replacement: Particularly concerns about AI and automation; employee anxiety about job security

- Siloed organizational structure: Departments operating in isolation without seeing the bigger picture; lack of cross-functional coordination

- Insufficient executive support: Leadership disagreement about change or failure to understand urgency

3. Lack of Systematic Data Management

The exponential growth of data from various sources, including IoT devices, has made data management and analysis a critical challenge. Without systematic data management—from collection and storage to real-time processing and analysis—organizations cannot fully leverage their existing data assets. This may result in missed opportunities for customer-centric services and accurate business decision-making.

Data Challenges (The 5 V’s of Big Data):

- Volume: Massive data influx from IoT, social media, and telematics requiring substantial storage and processing power

- Variety: Diverse data formats (structured, unstructured, semi-structured) requiring different management approaches

- Velocity: Need for real-time data processing to respond promptly to customer needs

- Veracity: Data accuracy and reliability requiring regular validation and cleansing

- Value: Extracting valuable insights from vast datasets for business decision-making

Common Problems:

- Data trapped in silos: Disconnected data preventing comprehensive customer views

- Absent data governance and quality management: No standards for data handling

- No single source of truth: Centralized confusion and conflicting information

- Inadequate tools and technology: For advanced data analytics

- Privacy concerns: Managing personal data privacy and security, especially PDPA compliance

4. Complex System Integration

Multiple systems from different vendors, built at various times using disparate technologies, make business process integration exceptionally complex. It’s like assembling a jigsaw puzzle with pieces from different boxes—never designed to fit together from the start.

Consequently, when organizations need to develop new features or connect systems with partner platforms, these developments become massive projects requiring extensive time and budgets. Sometimes integration attempts actually slow down or destabilize the overall system.

Integration Challenges:

- System diversity: Numerous systems from multiple vendors using different technologies complicate connections

- Varying data formats: Each system uses different data formats requiring complex data transformation

- Limited APIs: Many legacy systems lack APIs or have limited ones, necessitating additional middleware

- Security concerns: Maintaining security at every connection point adds management complexity

- Performance risks: Multi-system integration may reduce efficiency, create bottlenecks, or cause delays

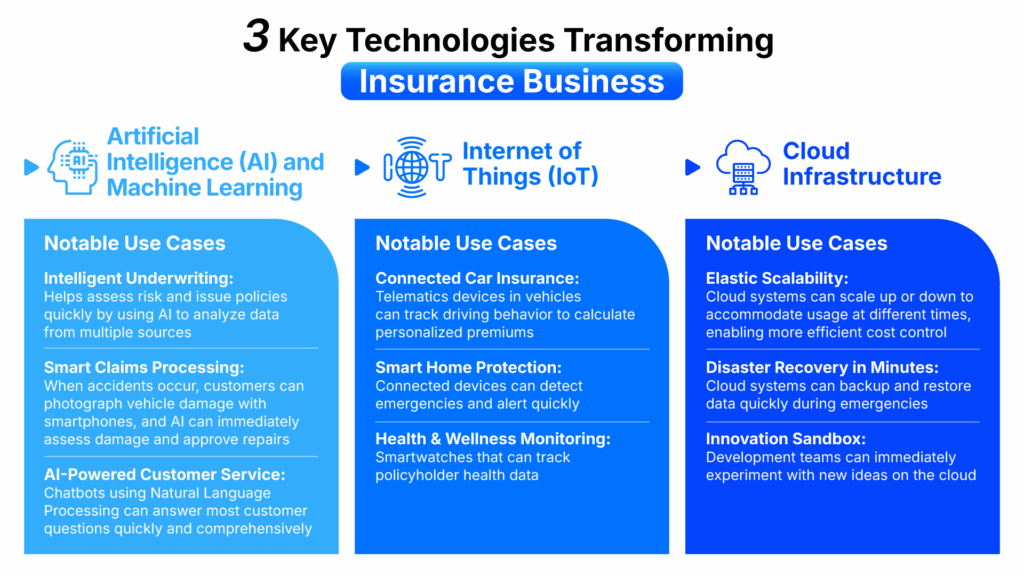

Game-Changing Technologies for Business

1. Artificial Intelligence (AI) and Machine Learning

AI and Machine Learning are revolutionizing nearly every aspect of insurance operations, from risk assessment to customer service, through their ability to process massive datasets and learn from experience.

Key Use Cases:

Intelligent Underwriting: Leading life insurers can now assess risk and issue policies within hours instead of weeks. AI analyzes data from multiple sources—health records, wearables, lifestyle behaviors, and other consented data—for more accurate risk assessment.

Smart Claims Processing: After accidents, customers can photograph vehicle damage with smartphones. AI can immediately assess damage and approve repairs, reducing claim processing time from days to hours while detecting fraud through abnormal claim pattern analysis, significantly reducing fraudulent payouts.

AI-Powered Customer Service: Chatbots using Natural Language Processing can answer most customer queries without human intervention, providing 24/7 multilingual service while learning from every conversation to deliver increasingly natural responses.

2. Internet of Things (IoT)

IoT is transforming insurance from “pay when incidents occur” to “prevent before they happen” through real-time data from various devices, helping both insurers and customers better manage risk.

Key Use Cases:

Connected Car Insurance: Telematics devices track driving behaviors—speed, braking, acceleration, turning, distance, and driving times. This data calculates personalized premiums where safe drivers receive substantial discounts while insurers significantly reduce accidents.

Smart Home Protection: Water leak sensors can automatically shut off valves when detecting leaks, preventing flood damage. Smoke and heat detection systems connected to fire departments help minimize fire damage.

Health & Wellness Monitoring: Smartwatches tracking policyholder health data—heart rate, sleep, exercise—enable insurers to create incentive campaigns like premium discounts, fitness vouchers, or reward points to encourage healthy living.

3. Cloud Infrastructure

Cloud infrastructure isn’t just about moving systems online—it’s about unlocking potential for rapid, flexible, and cost-effective development and service delivery.

Key Use Cases:

Elastic Scalability: Cloud systems can scale to accommodate usage patterns, such as insurance purchase spikes during special events. Systems can expand immediately to handle transactions without purchasing additional servers, then scale down when demand decreases, enabling efficient cost control.

Disaster Recovery in Minutes: Instead of investing heavily in backup data centers, cloud systems can backup and recover data quickly during emergencies, ensuring business continuity even during unexpected events.

Innovation Sandbox: Development teams can immediately experiment with new ideas on cloud platforms without waiting for hardware approval, reducing prototype creation from months to weeks. Failed experiments can be terminated without significant costs.

Driving Successful AI-led Enterprise Digital Transformation

AI-led Enterprise Digital Transformation isn’t just about implementing AI in parts of the organization—it’s about transforming the entire organizational system with AI at its core, creating new capabilities that deliver Business Agility, Operational Efficiency, and Customer-Centric Innovation.

Building Strong Foundations

Successful transformation begins with solid foundations, not rushed technology adoption without clear direction. This should encompass:

- Data Foundation: Establish standardized data management systems with clear Data Governance frameworks and reliable Data Quality. AI technology only performs well with quality input data—”Garbage in, garbage out.”

- Technology Infrastructure: Build infrastructure supporting business growth, including flexible cloud architecture facilitating multi-system connectivity with robust security measures.

- People & Culture: Develop people and culture alongside technology. Create a Digital Mindset throughout the organization, not just IT. Provide continuous training to develop employee skills and create environments encouraging experimentation and accepting failure.

Strategic AI Implementation

AI must be deployed purposefully, aligned with business strategy—not just because others are using it. Start with:

- Start with High-Impact Use Cases: Begin by strategizing technology implementation to identify use cases delivering real business results, such as reducing claim processing time, improving customer service, or enhancing internal operational efficiency.

- Scale Gradually: Expand technology scope incrementally, selecting what best aligns with organizational goals.

- Measure and Optimize: Measure concrete results including business outcomes (ROI, cost reduction, revenue growth) and operational outcomes (processing rates, process accuracy, customer satisfaction), then use this data for continuous improvement.

Creating Sustainable Ecosystems

Digital Transformation isn’t a project with an endpoint—it’s a continuous journey.

- Partnership Ecosystem: Collaborate with technology partners, educational institutions, and even industry peers to co-create innovation.

- Continuous Innovation: Foster organizational innovation culture, establish innovation labs, encourage employee ideas, and regularly experiment with new technologies.

- Future-Ready Capabilities: Prepare for the future by tracking emerging technologies like Quantum Computing, Metaverse, and Generative AI. Develop capabilities for rapid adaptation to change.

Enterprise Transformation: Turning Challenges into Opportunities

Insurance businesses that will survive and thrive are those that successfully transform themselves. Change may seem daunting and challenging, but the risk of not changing is greater.

AI-led Digital Transformation can turn challenges into opportunities, including:

- Competitive capabilities superior to traditional competitors

- Operational efficiency improvements by leaps and bounds

- Customer satisfaction increases from faster, personalized services

- Innovation capabilities rapidly addressing market needs

- Long-term business sustainability

The journey may be long and obstacle-filled, but with clear vision, appropriate strategy, and commitment to change, insurance businesses can definitely become digital-era leaders.

The critical question isn’t “whether to transform” but “when and how to begin”—because in this rapidly changing world, early movers always have the advantage.

At Bluebik, we believe successful transformation comes from strategically integrating technology with business thinking. As a leading regional Enterprise Transformation consultancy, we’re ready to drive your organizational change with comprehensive services spanning Big Data & AI, Cybersecurity, Digital Excellence, ERP Implementation, Management Consulting, and Strategic PMO.

Today’s decisions may be the compass directing tomorrow’s business. If your organization seeks a partner ready to guide you toward sustainable, effective transformation, Bluebik would be honored to be part of that journey.

📩 Contact Bluebik to discover the right approach for your organization

✉ [email protected] ☎ +66 2-636-7011

![Thumbnail [Post Event] HOW](https://bluebik.com/wp-content/uploads/2025/12/Thumbnail-Post-Event-HOW.png)